Centrelink is a government agency that provides several welfare payments and services to families, carers, job seekers, students, and retirees. Its responsibilities include the administration of social security and family assistance payments, child support, pensions and allowances, and others such as the National Disability Insurance Scheme (NDIS).

You can qualify for Centrelink advance loans if you’re currently under any of the Centrelink benefits. In this article, we’ll cover how you can get them.

How to Get Money from Centrelink Loans

To get loans on Centrelink, you can follow the steps below:

Find a Reliable Lender

Centrelink loans aren’t available on every lending platform. So, you might have to do a little digging.

The best place to start is on the internet. You can search for Centrelink lenders or any term that best describes what you’re looking to find.

However, check the eligibility of the lender. One way you can do this is by confirming their licence from the Australian Securities and Investment Commission. You can also check their services by reading customer reviews on platforms like Trustpilot.

Check if You Qualify

Depending on the lender, some Centrelink benefits might not qualify for a quick loan. For example, some lenders don’t offer loans for students on Centrelink. So, check with your lender to know what’s available.

Also, check if you have outstanding debts against your name with Centrelink. Your lender will consider this while assessing your eligibility.

Choose a Loan Amount

When you apply for a Centrelink loan, you’ll need to choose the amount you need. Depending on your lender, you can get at least a $500 Centrelink loan.

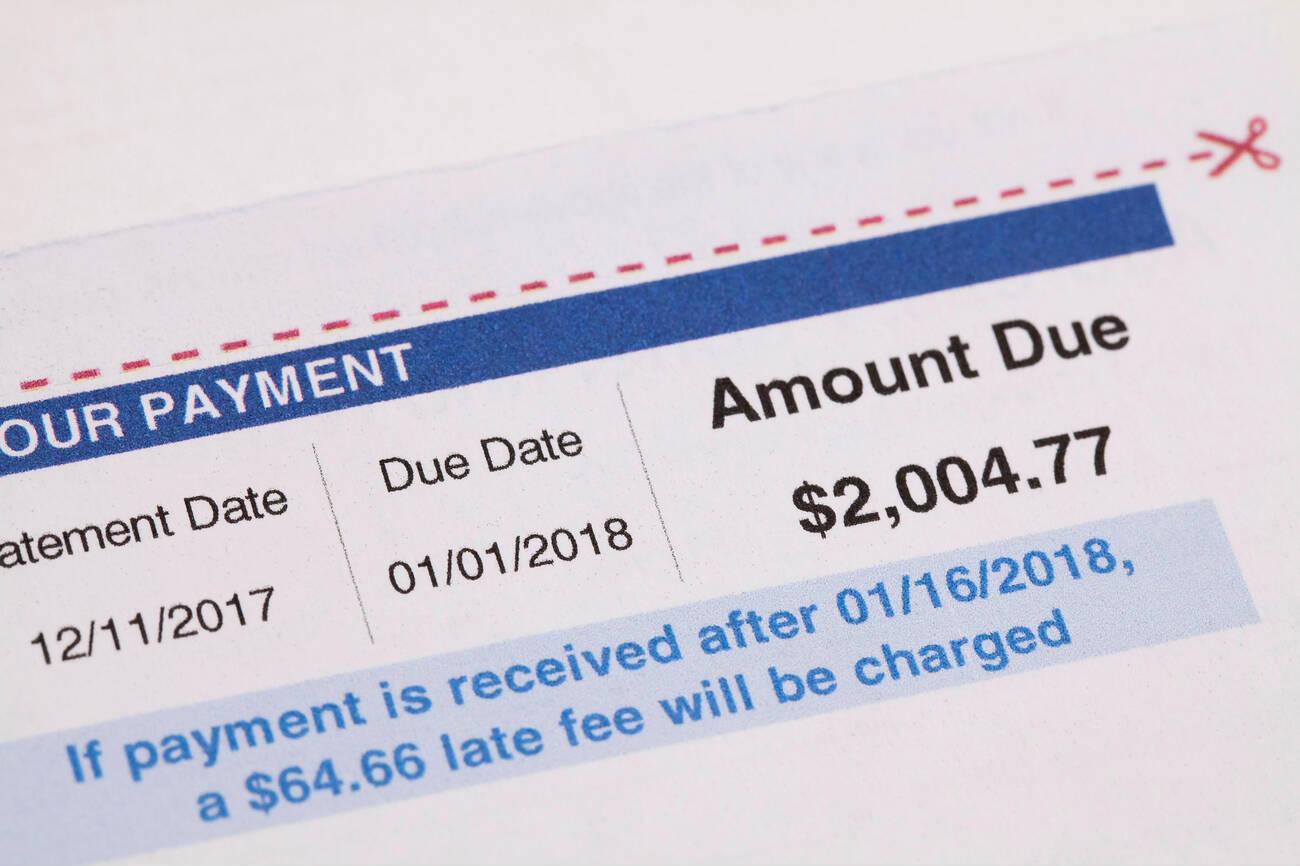

However, the lender will consider your monthly income based on their terms. For instance, you might need to have an income of over $2,000 to apply for a Centrelink loan payment. And in some cases, you might need an income of up to 50% from Centrelink.

Apply and Receive Your Funds

The loan application process is fairly straightforward. You’ll need to fill out a form and upload some documentation, including your Centrelink benefits card and a recent payslip or tax return.

Once you’ve completed the paperwork, you should get the funds in your bank account within 24 hours.

The loan can be paid back over a while or repaid early without penalty.

Conclusion

So, if you’re feeling a little strapped for cash, don’t worry; there are still some ways to get ahead. However, remember that Centrelink benefit loans have requirements and deadlines to meet before taking out any money. But if you do everything right, it doesn’t take long.

Was the guide helpful? Check out these extra resources to delve deeper:

- Micro Loans for Centrelink Customers

- Centrelink Financial Hardship

- Debt Consolidation Loans for Centrelink Customers

- Instant Cash Loans on Centrelink 24/7

- Guaranteed Approval Loans for Bad Credit Applications Centrelink Australia

- Emergency Cash Loans No Credit Check Centrelink

- White Goods Loan Centrelink

- Fair Loans for Centrelink Customers

- Guaranteed Debt Consolidation Loans for Bad Credit Australia Centrelink

- Centrelink Loans for Car Repairs

- Bond Loans for Centrelink Customers

- $300 Loan with No Credit Check

- No Credit Check Loans: $5,000

- No Credit Check Secured Loan

- $1000 Loans with No Credit Check